how are rsus taxed in singapore

The taxable amount is determined by taking the number of RSUs that vested and multiplying it by the market price per share on the date the RSUs convert to stock. This typically occurs at vesting.

Stock Options Vs Rsu Restricted Stock Units Top 7 Differences

RSUs are taxed upon vesting.

. Withholding and Reporting - RSRSU Income Tax. RSU can be sold internally and yes you will be taxed for some papers. Taxable amounts are based upon FMV at the time of shares are granted.

The of shares vesting x price of shares Income taxed in the current year. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. RSU tax at vesting date is.

RSU tax is treated differently from stock options. Answer 1 of 3. Shares acquired before January 1 2011.

Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. Generally this is when the share options under the. Youre taxed when receiving RSU-associated shares.

If held beyond the vesting date the RSU tax when shares. This typically occurs at vesting. Typically some number of shares get withheld.

Capital gains tax is imposed only if the stockholder. Generally no withholding except for certain expatriates ceasing employment andor leaving Singapore based on deemed equity income. RSUs get taxed as regular income on the day you receive the stock the vesting date taxed based on the stock price that day.

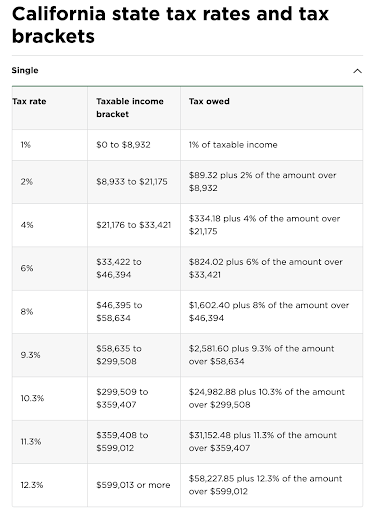

Tax Employee Tax Treatment For both Restricted Stock and RSUs an employee is generally subject to income tax on vesting. If you keep them for more than a year youll be subject to the more favorable. Many employers though make it far less convenient for the employee by withholding on supplemental income like RSUs and bonuses at a flat rate which includes.

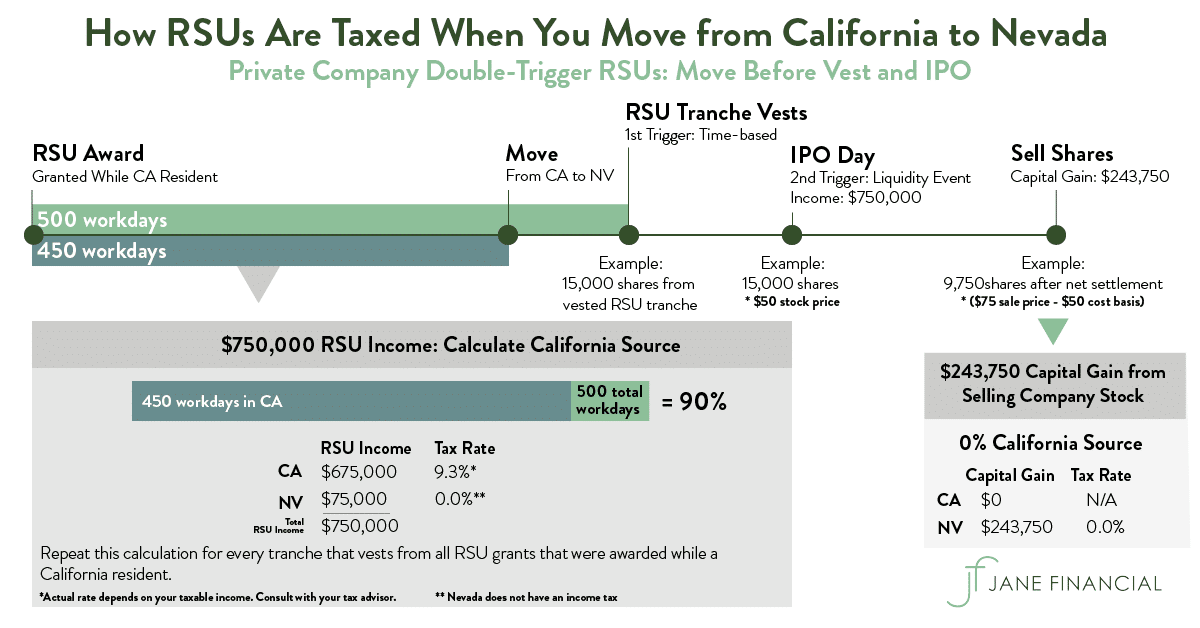

Most late-stage company RSUs have performance-based triggers so you dont receive them or get taxed until theres some possibility of liquidity. RSUs are taxed at ordinary income rates when issued typically after vesting. When you receive an RSU there is no immediate tax liability.

10 x 1000 100 Tax on ESOPRSU. For example if 100 RSUs. Restricted Stock and RSUs.

10 x 100 10 Administration RSU With RSU granting shares directly to employees may come with. Tax on Phantom Shares. Youll be taxed at the short-term capital gains tax rate if you keep your shares for less than a year.

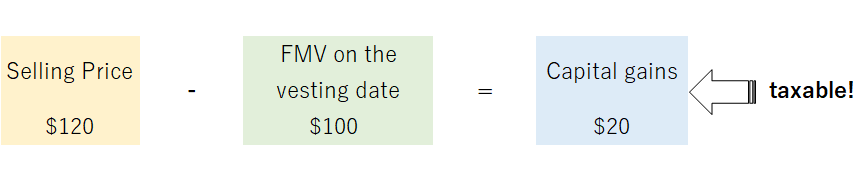

RSUs can trigger capital gains tax but only if the. If the shares were held less than 12. When you receive an RSU there is no immediate tax liability.

Capital gains tax is. Instead you must pay income tax when the shares are delivered to you. What this means is that when you are paid in RSUs and you make less than 1 million your employer will likely only send 22 of the RSU value to the IRS to cover the taxes.

Gains from the sale of shares held more than 12 months generally are not taxed. Ordinary Income Tax. An employee who is granted rights under an ESOP plan by an employer will be taxed on any gains or profits arising from the ESOP plan.

I think it is a good idea because if IPO happens You do not pay tax again and profit from the increase of the. Instead you must pay income tax when the shares are delivered to you.

How Should I Manage My Restricted Stock Units Trailhead Planners

Esop Tax Treatment Usa Vs Singapore Htj Tax

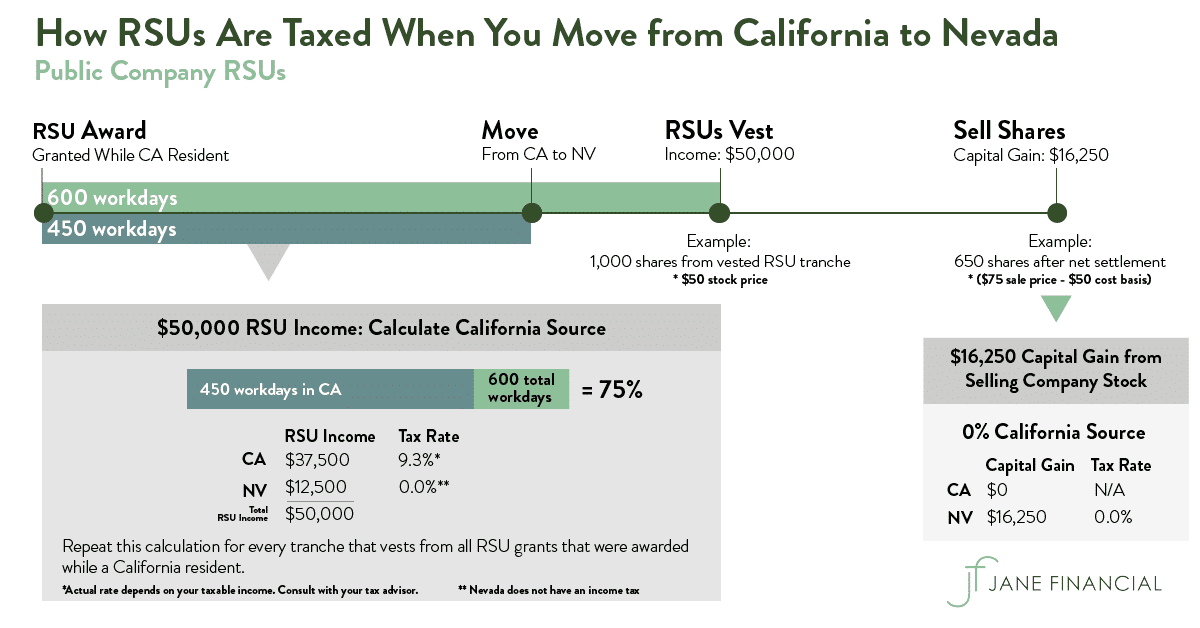

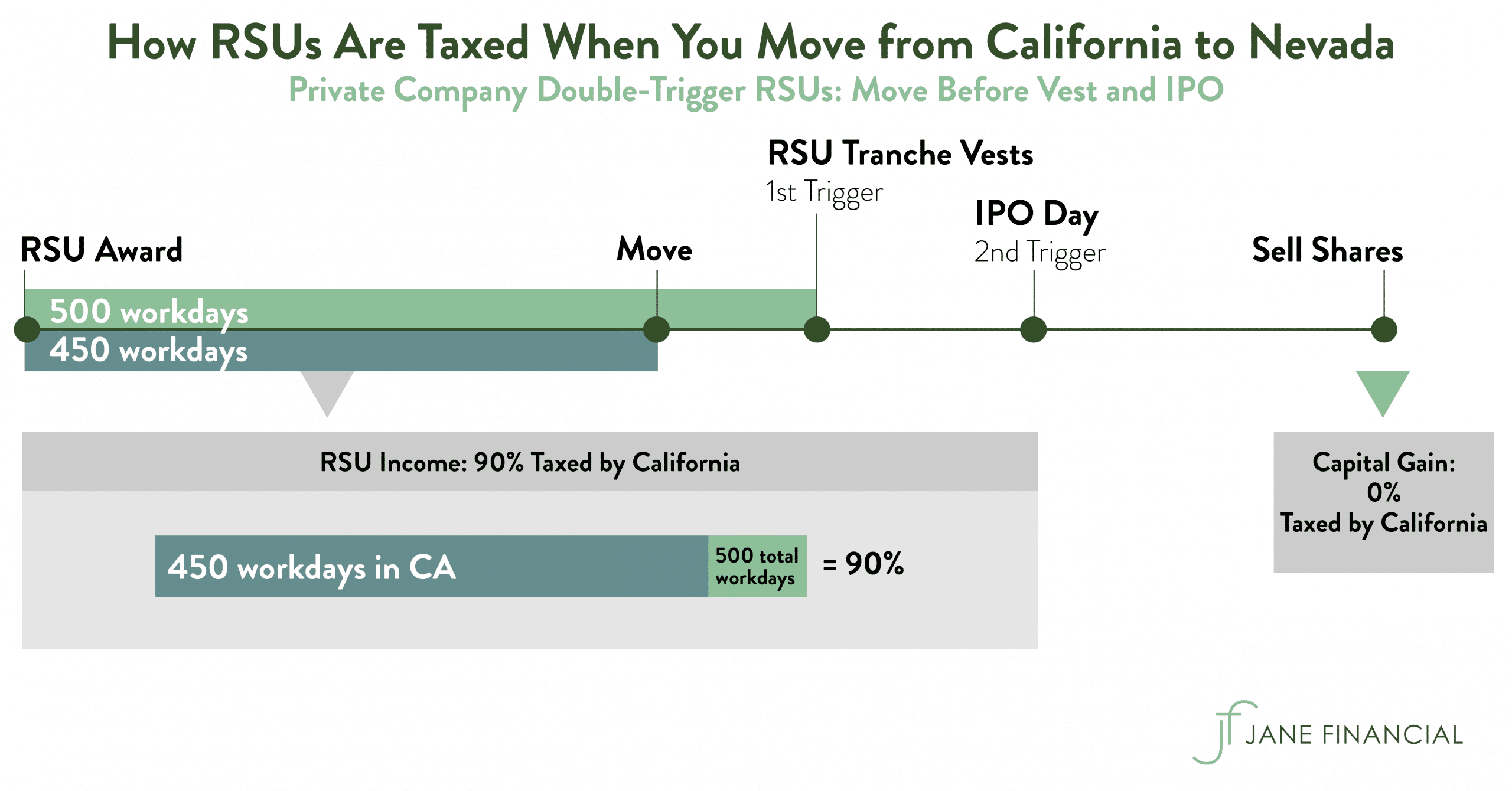

Restricted Stock Units Jane Financial

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

Filing A Tax Return In Japan For Share Based Compensation Rsus Employee Stock Options Employee Stock Purchase Plan From Overseas Parent Company Shimada Associates

Rsu Of Mnc Perquisite Tax Capital Gains Itr

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

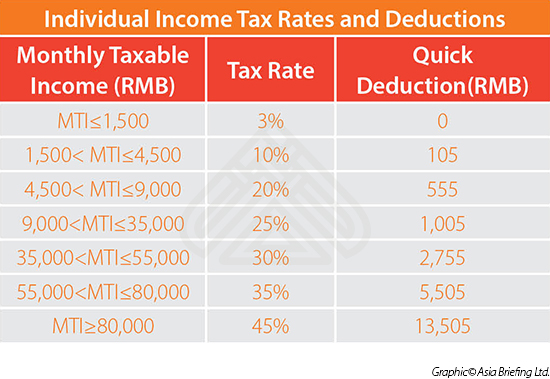

Granting Restricted Stock Units To Your Employees In China China Briefing News

Restricted Stock Units Jane Financial

A104 2020equityincentive Asana Inc 2021 Employee Benefit Plan Security Offering S 8

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

2019 Global Mobility Equity Survey Deloitte Us

Draft Finance Bill 2016 Restricted Stock Units

2020 Equity Incentive Plan Form Of Rsu Grant Notice And Award Asana Inc Business Contracts Justia

Tax Considerations For Restricted Stock Compensation Ticker Tape

Google Rsu And 401k What You Need To Know